Real Estate crowdfunding or REITs? This is an inquiry many clever land financial backers are thinking about post pandemic.

With financing costs so low, the interest for land has gone far up. It likewise takes significantly more cash flow to create a similar measure of hazard changed pay.

By and by, I’m bullish on the real estate market for quite a long time into the future. Thus, I’m effectively putting resources into Real Estate crowdfunding, REITs, and actual investment properties.

The inquiry certain individuals have posed is: Why should a financial backer put resources into a land crowdfunding stage like CrowdStreet or Fundrise rather than a Real Estate Investment Trust (REIT)?

How about we go through a profound plunge examination between land crowdfunding and REITs.

Real Estate Crowdfunding Or REITs

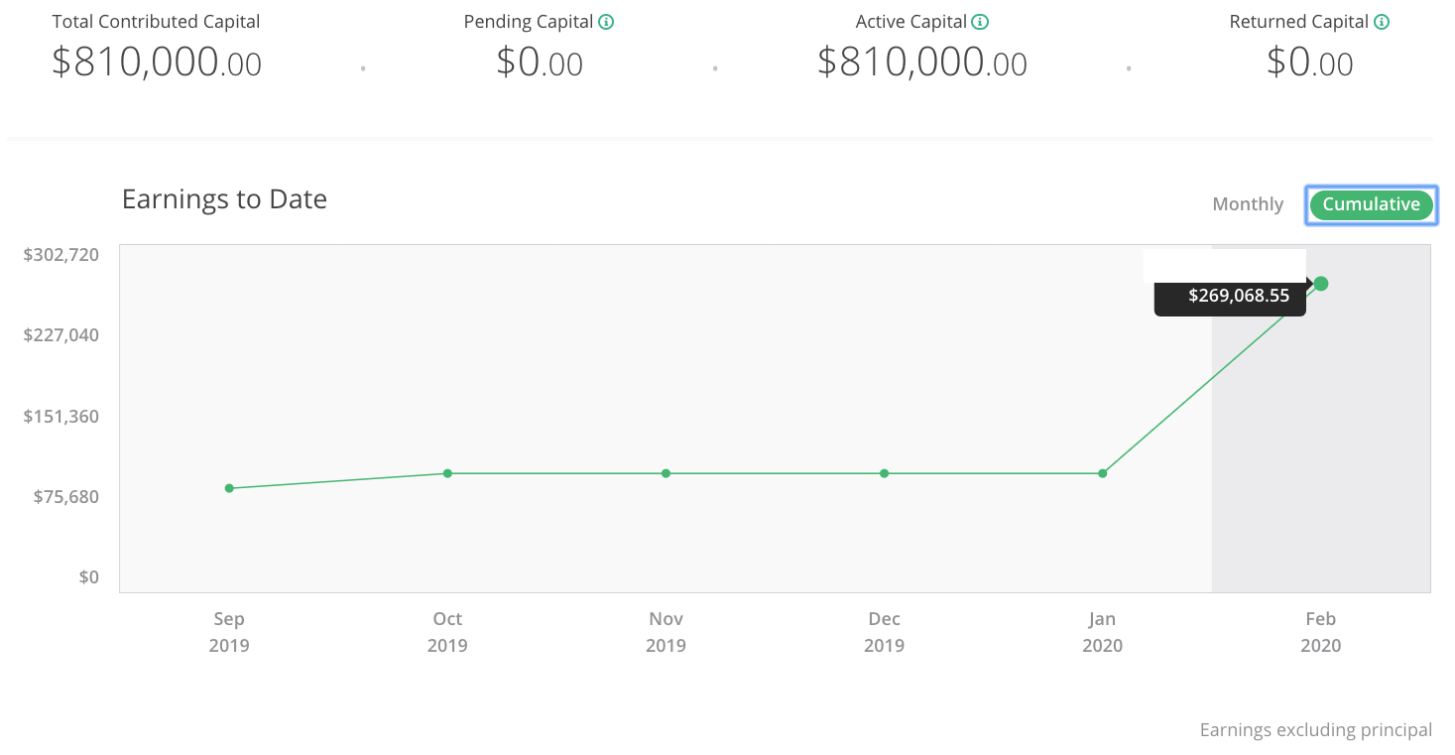

Via foundation, I’ve put resources into actual land in Honolulu, San Francisco, and Lake Tahoe since the mid-1990s. I’ve invested in REITs since the last part of the 1990s. Today, I have put $810,000 in land crowdfunding starting around 2016.

Already, I endured 13 years working in the values division of Goldman Sachs and Credit Suisse. I got my MBA from UC Berkeley and have been expounding on land financial planning on the web starting around 2009.

A land crowdfunding stage gives their financial backers direct admittance to land speculations. A REIT gives you more extensive openness to land without straightforwardly claiming the property.

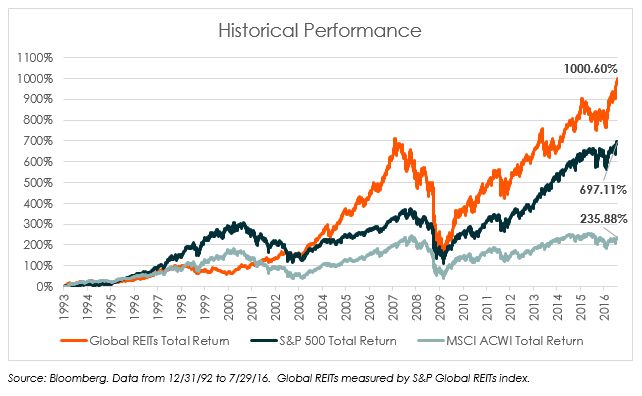

REITs don’t give cautious assurance to securities exchange unpredictability. What we saw was that public REITs auction off EVEN MORE than stocks. You can see a few models and more detail here. As such, public REITs have a higher beta or higher instability.

On the off chance that you’re searching for more steady land speculation, putting resources into land crowdfunding may offer less unpredictability.

What is a REIT?

A REIT is basically a partnership that possesses and deals with an arrangement of pay creating land properties like condos, lodgings, shopping centers, and places of business. Contracts are gotten by such land (Mortgage REITs or MREITs) or a blend of the two (Hybrid REITs).

REITs can likewise be private or public. Private REITs are not enlisted or exchanged with the Securities and Exchange Commission (SEC). They ordinarily raise the value from licensed financial backers (for example people, trusts, or different substances). Though public REITs are enrolled with the SEC and exchanged significant stock trades like the NYSE, NASDAQ, and AMEX.

There are more than 800 private REITs and north of 200 public REITs in the United States. Their complete resources are generally $400 billion. Appropriately, REITs make up just a negligible part of the $11-12 Trillion Dollar US Commercial Real Estate Market.

The absolute most famous public REITs include:

Realty Income Corporation (Ticker: O, 4% profit yield)

Omega Healthcare Investors (Ticker: OHI, 7.6% profit yield)

How REITs Compare To Real Estate Crowdfunding

Land Crowdfunding and REITs are comparable in a lot of ways. The two choices offer financial backers equilibrium and enhancement from the customary stock and security markets. The two ventures additionally offer worth from both the ongoing pay created from rents. At last, the two speculations offer the potential for long-haul enthusiasm for the basic land resource.

Both venture choices additionally grant financial backers to pool their capital with different financial backers. This offers a less capital escalated method for putting resources into a more extensive scope of land.

At long last, similarly as with a Fundrise venture when you put resources into a REIT, you do so latently. In this way, you don’t need to stress over the everyday tasks and the executives of the resource. Rather these things are taken care of by a respectable supervisory group.

Significant Differences In REIT Versus Real Estate Crowdfunding

The principal distinction between Fundrise speculation and a REIT venture is that with Fundrise you are putting straightforwardly into unmistakable business land. While with a REIT, you are putting resources into an organization that thusly puts your cash into the real estate.

As a matter of fact, up to 25% of a REIT’s all-out speculations can be in resources other than land. In like manner, Fundrise offers financial backers more control and straightforwardness than a REIT since financial backers can by and by choosing each pre-screened venture a valuable open door.

Benefits Of Real Estate Crowdfunding Over REITs

1) Potential Higher Leverage and Higher Returns. Direct property possession benefits from the force of influence (up to 80%) while REITs are by and large utilized at or under half. Higher influence implies higher possible returns (since you can purchase more property with less value).

2) Less Volatility. Despite the fact that promoted as a viable method for differentiating a stock portfolio, the exhibition of REIT shares has firmly followed generally value market execution bringing about connection coefficients as high as 0.86 (as soon as 2011).

This implies that public REITs are moving in close to lockstep with the market at large. REITs are dependent upon similar instability as we found in March 2020. During a similar period, the tantamount value market relationship for private land has been near 0.14 (going from – 0.03 and +0.25; an exceptionally low connection).

3) More Transparency and Control. At the point when you put straightforwardly into a land resource, you know the exact thing you are getting. In this manner the interaction is straightforward and you keep a specific degree of control. Then again, when you put resources into a REIT you are getting involved with a company that possesses a pool of properties. You may not know precisely where your venture dollars are going.

Real Estate Crowdfunding Changing Investor Access

REITs have been the main feasible choice for retail financial backers until the section of the JOBS Act in 2012. Land crowdfunding has democratized admittance to business land.

In the event that you are not a licensed financial backer ($200K pay or $1M total assets barring main living place), not an issue. You can investigate Fundrise’s eREIT choice.

They resemble a crossover of individual land crowdfunding ventures and private REITs. The charges are moderate and you get to get to a more centered land locale in America.

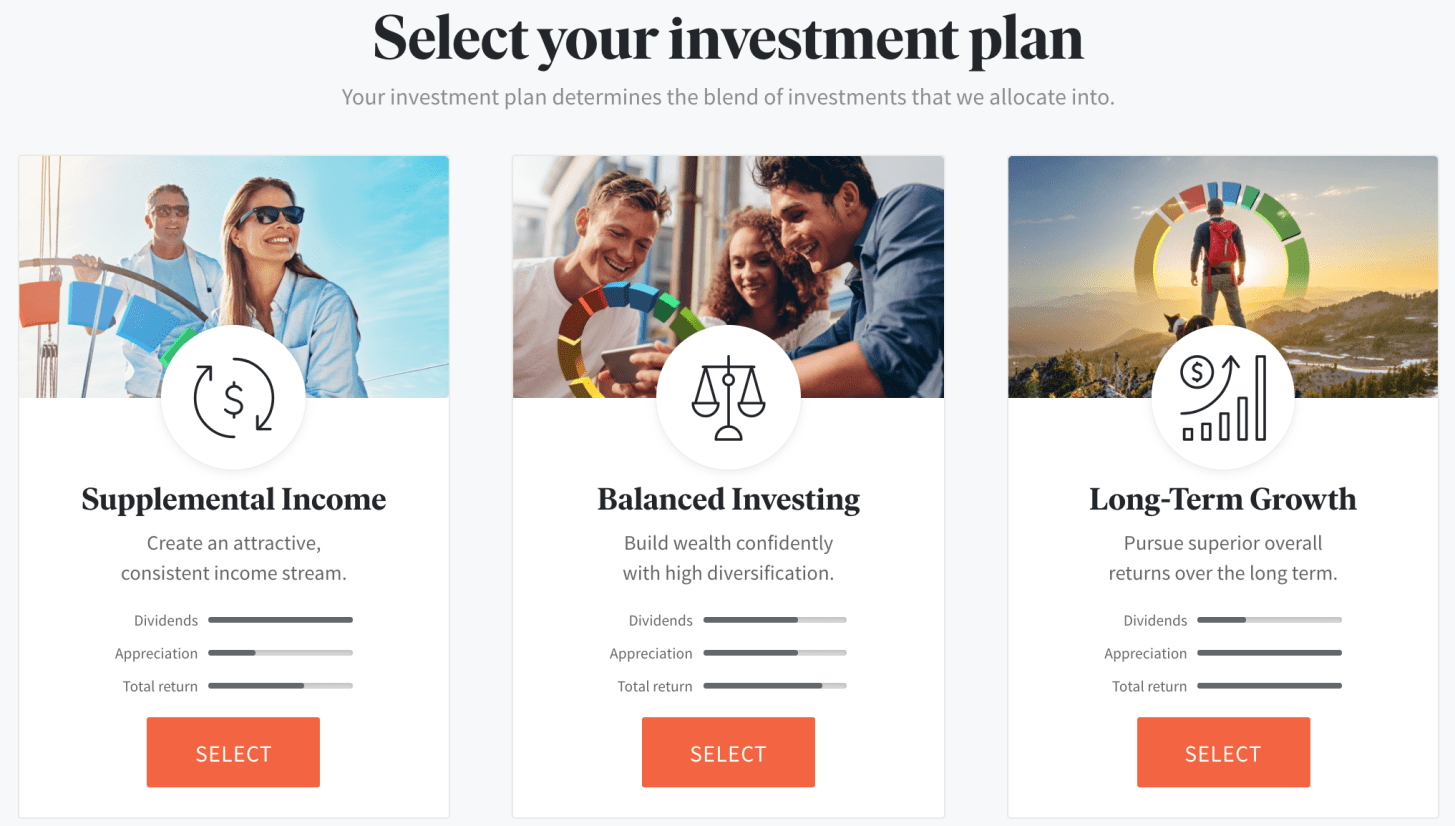

Here are the ongoing three Fundrise money growth strategies financial backers can browse after financial backers choose the size of their speculation. Contributing a portfolio is a more differentiated, more secure approach than putting resources into only one business Real Estate project.

Bullish On Real Estate Crowdfunding

Land crowdfunding will be a gigantic chance for financial backers in the approaching ten years. The innovative stage will open up a surge of capital from costly waterfront urban communities toward reasonable midland states.

Further, the pay learning experiences in the heartland hope to have probably the biggest potential gain in the country. This is especially true as financial backers are more ready to telecommute after the worldwide pandemic.

Great financial backers generally contemplate mainstream changes, paying little heed to where they stand on the political range. In this way, I accept heartland land ought to beat throughout the following 10 – 20 years.

Why Heartland Real Estate Will Outperform

- There will be a net movement out of Blue states into Red states. More individuals understand it’s an incredible arrangement living in Texas on the off chance that you can get 3X as much for 1/third the cost.

- As our nation progresses in years, more retired folks will move out of Blue states to extend their retirement dollar.

The remote work pattern will go on because of innovation and a tight work market. - Pay development ought to be higher in Red states because of segment moves and organizations extending internally.

- Now that putting resources into land is more effective, Red State’s 10%+ rates of return contrasted with <4% rates of return in Blue urban communities are too difficult to even think about overlooking. The spread ought to be limited.

- An expected extension of who can put resources into land publicly supporting will prompt an expansion popular and costs.

- The ascent of land publicly supporting stages, for example, Fundrise and CrowdStreet build the stock of capital. Along these lines expanding the interest and costs of already difficult to tap speculations. Both are allowed to join and investigate.

- SALT derivation of $10,000. Further, a decrease in the home loan interest derivation breaking point to a $750,000 contract is a net negative for waterfront city land. However, great until the end of the country who benefit more from the multiplying of the standard allowance.

- I’m likewise bullish on land by and large in 2021 and then some. With wages rising, contract rates falling, the securities exchange recuperating, and land-related stocks outflanking the S&P 500, I see actual land costs making up for a lost time.

I like having the option to broaden into business land with just $500. No need to use up to purchase a solitary property on account of Fundrise is great in this dubious climate.

I’m certain land will keep on being perhaps the most ideal way to create financial momentum over the more drawn-out term. Between land crowdfunding or REITs, I incline toward land crowdfunding. I could do without the instability of REITs, as exhibited during the March 2020 securities exchange crash.