This post will examine the top states to purchase land in 2022 and then some.

Land moderateness is up in light of the fact that home loan rates are down. In any case, contract rates are presently crawling back up. The S&P 500 quit for the day by 16% in 2020 after a gigantic convention in 2019. In 2021, the S&P 500 shut everything down by 27%! Subsequently, financial backers are more affluent generally speaking.

Pay is up and work is recuperating. Further, there is the craving to turn into additional guarded resources. The real estate market ought to remain solid into the indefinite future.

It’s vital to peruse Financial Samurai or other individual accounting destinations that compose from direct insight. In the event that you do, you can as a rule get a superior feeling of what’s rolling on continuously. With better data comes possibly better speculation choices.

For instance, when I talked about just having the option to track down inhabitants for 15%, not exactly my past requesting rent in 2017 following 45 days from forceful looking, you could have deciphered the datapoint as proof that costly waterfront city housing markets had crested and were declining.

We are just now finding in the information that housing markets in numerous seaside urban communities finished out around the finish of 2017. Simply know that when the information hits standard, it’s generally expected not the most ideal opportunity to take a monetary action.

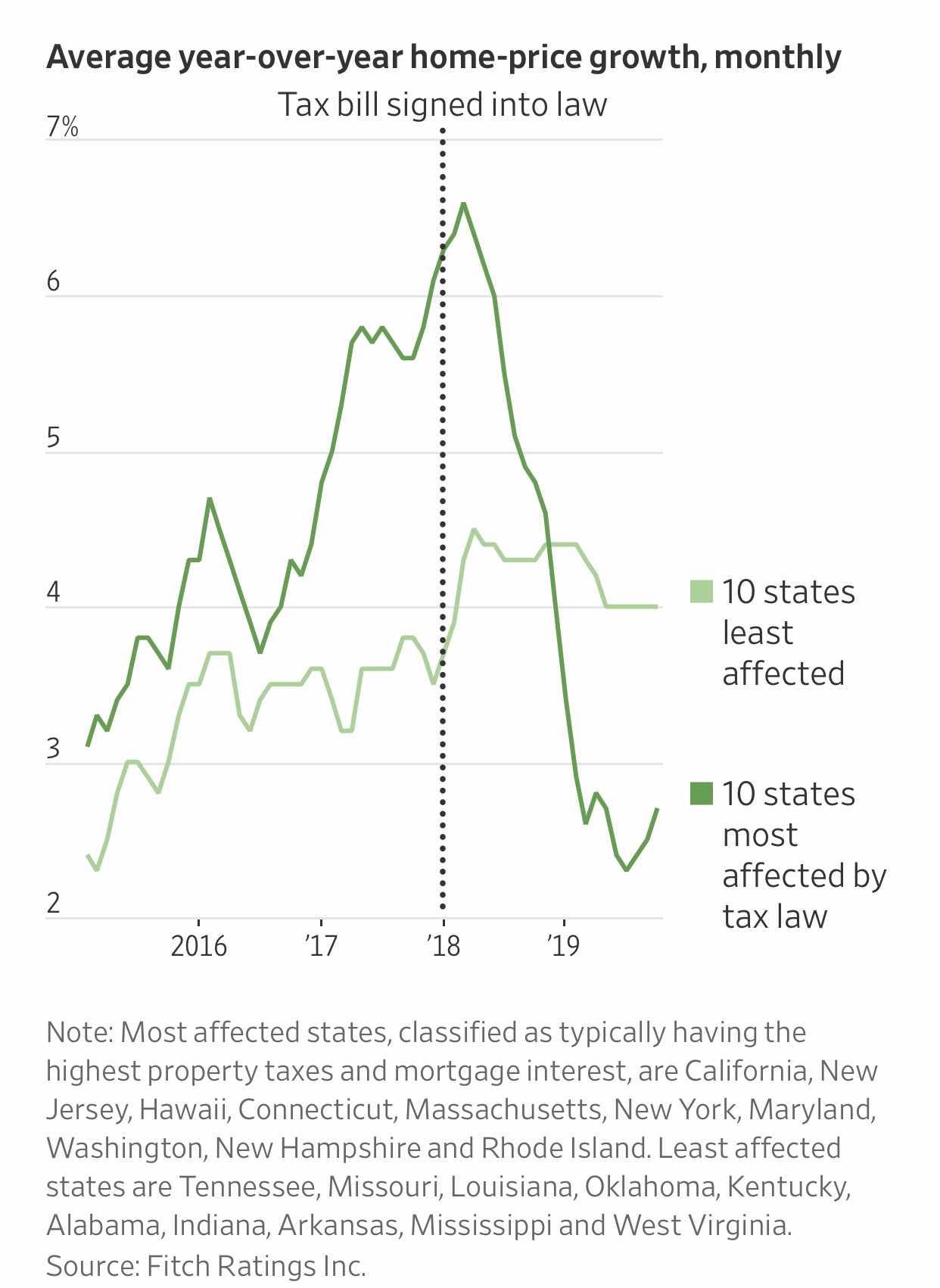

Home Price Growth Rates Since The SALT Cap

One reason why I thought seaside city land costs would ease back was because of the new assessment regulation that covered State and Local Tax (SALT) allowances at $10,000.

States with probably the most elevated home costs include California, New Jersey, Hawaii, Connecticut, New York, and Washington. A mortgage holder’s yearly local charge bill in one of these states alone could far outperform $10,000 per year.

Investigate the diagram beneath. It shows the home-cost development for the 10 most costly states and the 10 most economical states.

Decrease In Real Estate Prices

As you can tell from the graph, home-cost appreciation for the 10 most costly states dove from a pinnacle of around 6.6% toward the start of 2018 to only 2.6% by 2H2019.

Then again, home-cost appreciation for the 10 most affordable states remained predictable at generally 4%. Not just has home value appreciation been all the more consistent, however, home cost appreciation in all costly states is additionally now higher than home cost appreciation in the 10 most costly states. Further, valuations are a lot lower, and rates of return are a lot higher too.

In the event that you are somebody who likes low unpredictability and consistent pay, putting resources into the 10 most economical states is appealing.

It is extremely certain that my proposal of putting resources into the Heartland Of America is working out. Red states are beating blue states.

Be that as it may, President Biden is presently in power, and the SALT cap derivation could get lifted. One ought to accept that states like California, New Jersey, Hawaii, and Connecticut will benefit assuming this is the case. With costly states slacking more affordable states since the pandemic started, I would focus on huge city living once more.

The Top States To Buy Real Estate By Migration Trends

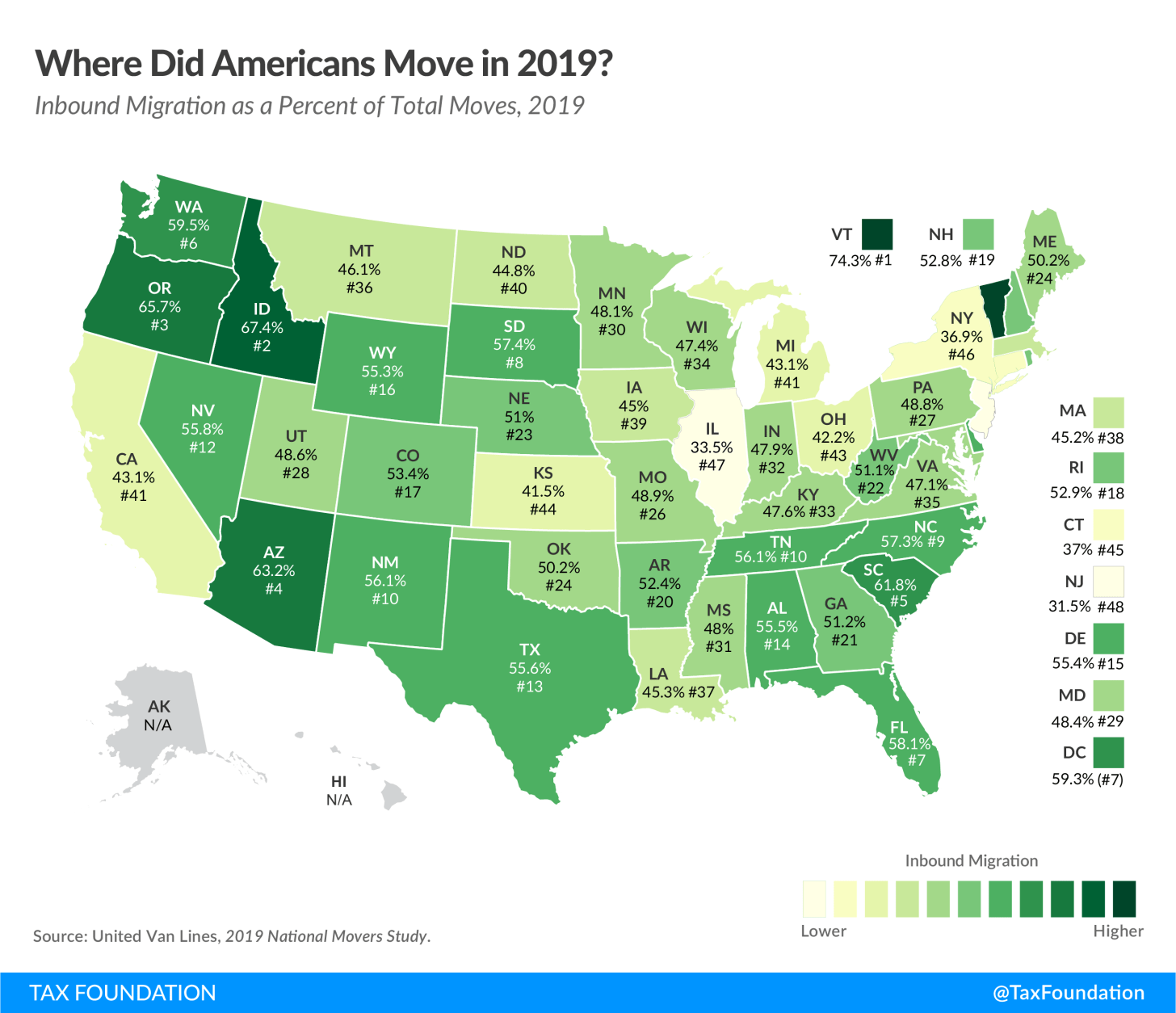

In 2022, the situation is marginally unique. To settle on the top states to purchase land in the new 10 years, we ought to take a gander at relocation and supply patterns. At the point when individuals are really making a statement, you realize there is a genuine open door.

Individuals move to an alternate state for the most part for a mix of open positions, nature of living, and the average cost for many everyday items. Modest lodging alone is a lacking justification for moving to a specific state.

Here is some information from United Van Lines 2019 National Movers Study that shows the states with the most inbound relocation. The heartland states are a portion of the top states to purchase land.

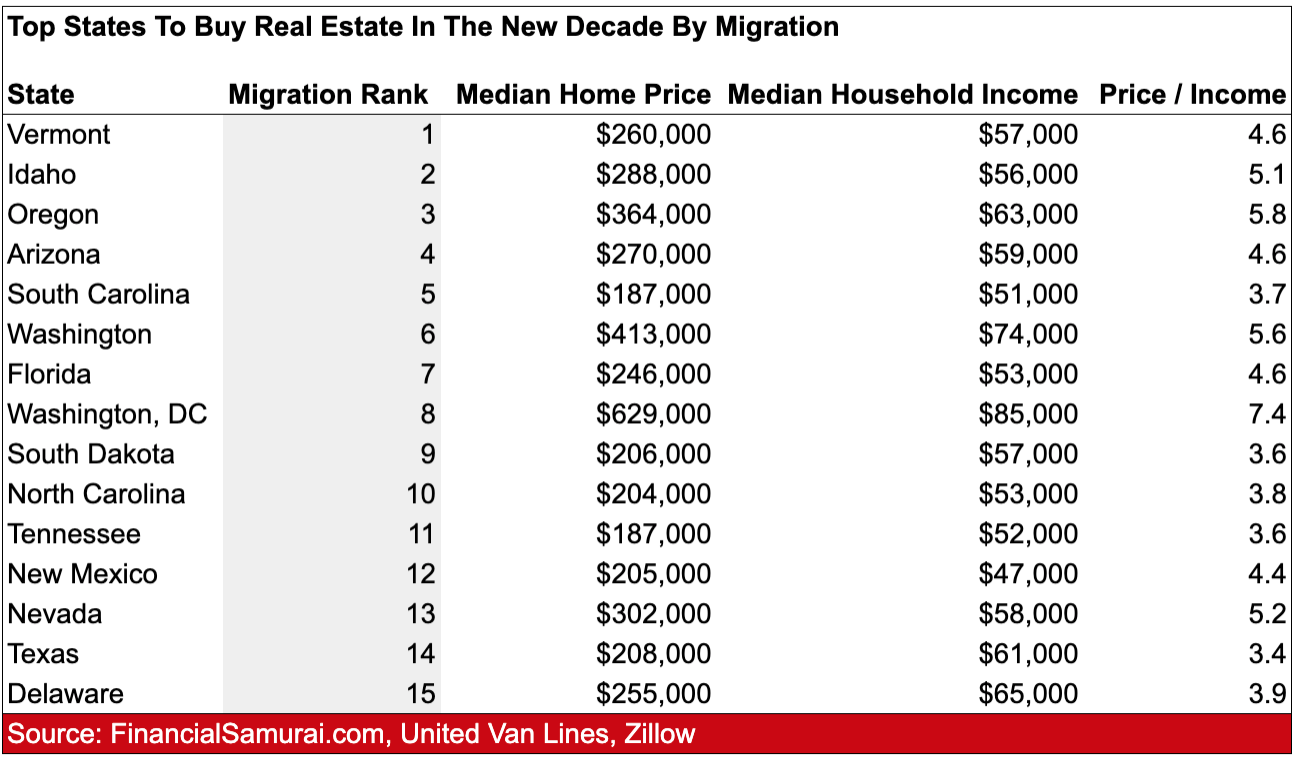

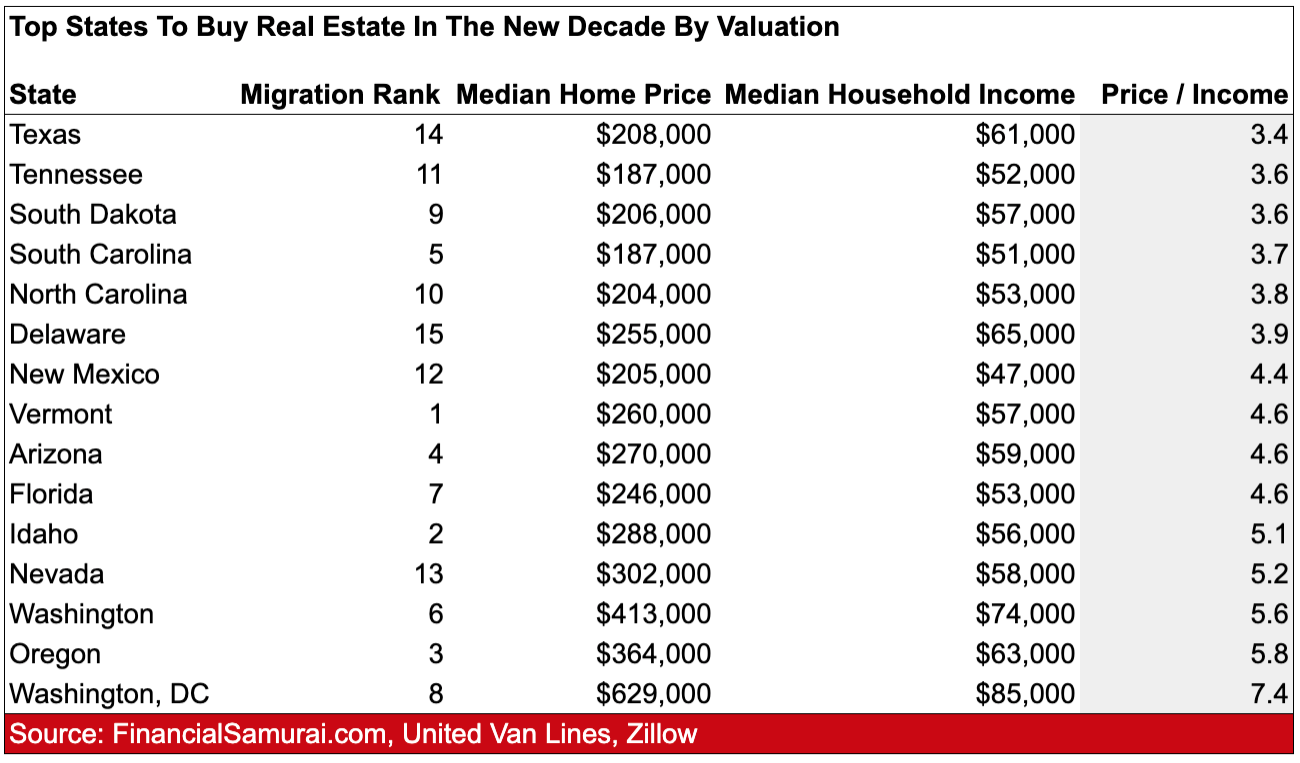

In view of the moving review, beneath are the main 15 spots where Americans are moving to in addition to the middle home cost and middle family pay. I’ve made the information into an outline also.

Top 15 States To Buy Real Estate

The following are the top states to purchase land in the new ten years by movement and middle home cost.

- Vermont – $260,000 middle home cost, $57,000 middle pay

- Idaho – $288,000 middle home cost, $56,000 middle pay

- Oregon – $364,000 middle home cost, $63,000 middle pay

- Arizona – $270,000 middle home cost, $59,000 middle pay

- South Carolina – $187,000 middle home cost, $51,000 middle pay

- Washington – $413,000 middle home cost, $74,000 middle pay

- Florida – $246,000 middle home cost, $53,000 middle pay

- Washington, DC – $629,000 middle home cost, $85,000 middle pay

- South Dakota – $206,000 middle home cost, $57,000 middle pay

- North Carolina – $204,000 middle home cost, $53,000 middle pay

- Tennessee – $187,000 middle home cost, $52,000 middle pay

- New Mexico – $205,000 middle home cost, $47,000 middle pay

- Nevada – $302,000 middle home cost, $58,000 middle pay

- Texas – $208,000 middle home cost, $61,000 middle pay

- Delaware – $255,000 middle home cost $65,000 middle pay

The unmistakable astonishment state on the rundown is Vermont at #1. Vermont is great, yet it is colder than your stripped bum on a concrete seat shrouded in ice. The biggest bosses are UVM Medical Center, University of Vermont, State of Vermont, IDX frameworks, Bruegger’s Enterprises, Casella Waste Systems, and Killington Ski Resort. These organizations aren’t by and large quickly developing and lucrative elements.

Further, Vermont has an ever-evolving state charge rate versus zero state charges in states like Texas, Nevada, Alaska, Florida, South Dakota, Washington, and Wyoming. The most reduced Vermont state charge rate begins at 3.55%, then, at that point, continuously knocks up to 7%, 8.25%, 8.9%, and finishes out at 9.4%. These state charge rates aren’t exceptionally alluring by any stretch of the imagination.

In any case, Vermont is #1 in relocation and has a sensible land valuation of 4.6X. In this manner, we should save Vermont from oversight.

Washington, DC, And Oregon

Washington state has a middle family pay of generally $74,000, 17% higher than the middle U.S. family pay of $63,000. Yet, its middle home cost of $413,000 is 69% higher than the middle home cost in the U.S. of $244,000. Hence, land in Washington state doesn’t appear to offer extraordinary relative worth, regardless of the number of travelers it gets from California and regardless of how high Amazon’s stock cost goes.

The middle family pays in Washington, DC is generally $85,203, or 35% higher than the middle U.S. family pay. Notwithstanding, the middle Washington, DC home cost is a forceful 158% higher than the U.S. middle home cost. In this manner, Washington, DC most certainly doesn’t offer great relative benefit either, regardless of how enormous government gets.

At last, Oregon, with its $364,000 middle home cost (49% higher than the public normal) and its middle family pay of $60,212 (4.7% below the public normal), is suspect too. Further, the climate in Oregon is like the climate in Washington state, not extraordinary. In spite of the fact that I really do like that Oregon has no deals charge and is totally delightful throughout the fall.

The Top States To Buy Real Estate By Valuation

Assuming you are a worth situated financial backer like me, you need to not just gander at the top expresses that are encountering the most convergence of individuals, you likewise need to see which states have the least expensive land valuations.

You believe that the SALT Cap derivation should make little difference to home cost development. Further, you need to have however much cost potential gain as could be expected. Notwithstanding, President Biden could ultimately revoke the SALT Cap, which would be a shelter for seaside states once more.

Despite the fact that for a particular property, it’s smarter to esteem it in light of its cost and net working pay (NOI), for state-wide land valuations, involving the middle family pay as the denominator is ideal.

In view of the outline, the main five states with the best worth are Texas (no state personal duty), Tennessee (no state annual assessment), South Dakota (no state personal expense), South Carolina, and North Carolina. Simply be cautious that few Texas urban areas like Austin are seeing huge license development, and that implies parts more stock.

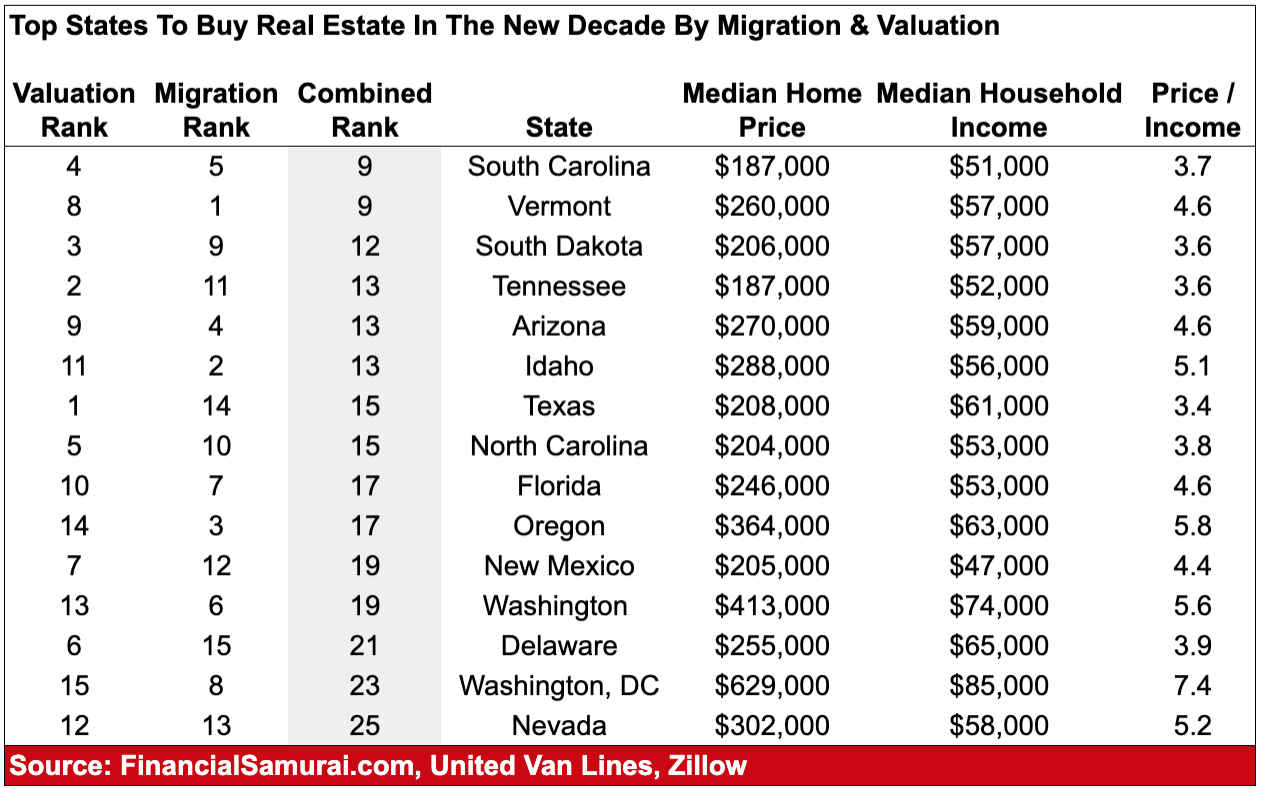

The top States To Buy Real Estate By Migration and Valuation

To equitably rank the states, the unmistakable arrangement is to consolidate the relocation and valuation rankings. Along these lines, you eliminate one-sided assessments like mine who think Vermont is excessively cold with insufficient lucrative positions.

The graph beneath sums the Valuation Rank and the Migration Rank to think of a Combined Rank for the 15 states.

As indicated by my joined positioning investigation, the main five states to purchase land in view of movement patterns and valuation are South Carolina, Vermont, South Dakota, Tennessee, and Arizona.

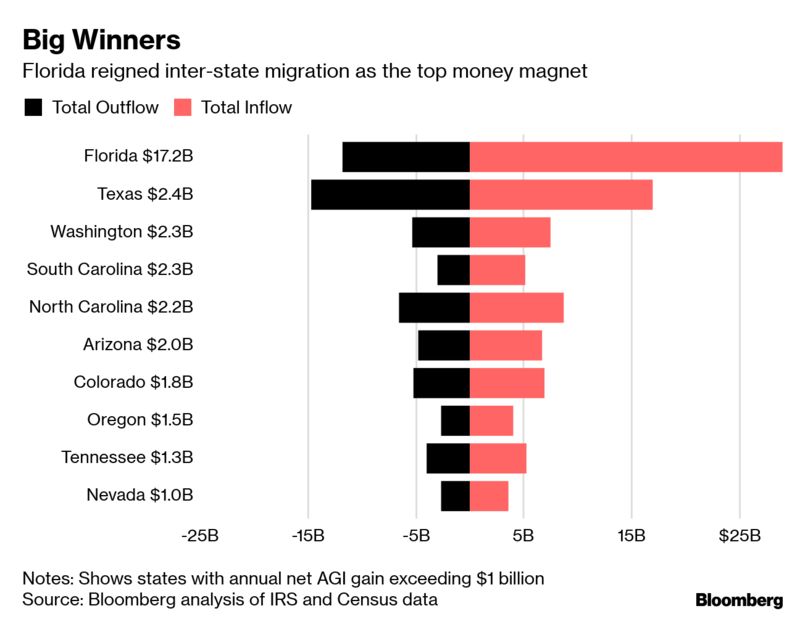

Valuations and Demographic Trends Matter

As well as understanding relocation and valuation patterns by express, it’s likewise really smart to see which states are the top cash magnets. All things considered, more cash pushes up home costs. Costly beachfront cash is the reason individuals who live in cheaper states frequently object to out-of-state purchasers.

As you can see from the diagram above, Florida, Texas, Washington, South Carolina, and North Carolina are the best five cash magnet states.

As a costly seaside city inhabitant hoping to enhance his land property inland, when you join every one of the information, beneath are my number one five states for land effective money management.

My #1 states for land financial planning are:

- South Carolina – $187,000 middle home cost, $51,000 middle family pay

- Tennessee – $187,000 middle home cost, $51,000 middle family pay

- Texas – $208,000 middle home cost, $59,000 middle family pay

- South Dakota – $206,000 middle home cost, $57,000 middle pay

- North Carolina – $204,000 middle home cost, $53,000 middle pay

The middle home cost to middle family pay proportion of ~3.7X for these five states is alluring. Nonetheless, your main five states ought to be different relying upon where you reside.