It has arisen as one of the most blazing venture areas since the JOBS Act of 2012 passed. The JOBS Act empowers individual financial backers to participate in bigger speculations generally saved for richer financial backers.

The entire thought of putting resources into land crowdfunding is to exploit more quickly developing business sectors with higher rates of return (net rental yields), while NOT zooming around the nation and concocting enormous measures of capital.

Subsequent to selling my SF investment property in 2017 for a 30X yearly gross lease, I continued to reinvest $500,000 of my returns in properties around the Midwest exchanging at a 10X yearly gross lease with 8% – 12% net rental yields.

Here are a few motivations behind why land crowdfunding might be an alluring venture for you.

Why Real Estate Crowdfunding Is An Attractive Investment

1. REITs Are Too Diverse

At the point when you put resources into a REIT, you get all that they put resources into. You can’t single out. There are many properties in a REIT, large numbers of which are not in regions you want to put resources into.

In the meantime, a REIT store puts resources into different REITs, which makes your land venture openness much more assorted. Variety is fine. Yet, in the event that you are explicitly putting resources into land, you need to put resources into the most elevated development markets with the most potential gain potential.

The main 10 REITs by market cap are:

- Vanguard Real Estate II Index Fund

- Simon Property Group Inc.

- Prologis Inc.

- Equinix Inc.

- Public Storage

- AvalonBay Communities Inc.

- Value Residential

- Advanced Realty Trust Inc.

- American Tower Corp.

- Welltower Inc.

REC Investing Offers Choices

With crowdfunding land destinations, you have choices. You can put resources into individual properties or you can pick firmly engaged eREITs with a firm like Fundrise. Fundrise is one of the most established land crowdfunding stages with more than 150,000 clients and $1+ billion made due.

The public REITs are gigantic. They have colossal geographic impressions, so you can’t observe shortcomings and exploit them.

Assuming you like to put resources into individual land and open doors in 18-hour urban areas, look at CrowdStreet. They likewise have an awesome stage you can investigate for nothing. I met with around 10 individuals there when they came to San Francisco.

2. More Selection For Non-Accredited Investors

In the event that you are an authorized financial backer, you have total assets barring your main living place of somewhere around $1 million. Or then again you procure somewhere around $200,000. Numerous private speculations are just for authorized financial backers.

Notwithstanding, on the off chance that you are not an authorized financial backer, you can in any case put resources into land crowdfunding. How? Through REITs imagined by Fundrise. Fundrise is one of the forerunners in the non-licensed land effective financial planning space. The base venture is just $1,000 to put resources into their eREITs. They have five REITs zeroed in on districts, pay, and development.

They additionally have “ePlans” with $500 essentials. You pick whether you need pay or appreciation and your degree of chance. Then they put you in an asset that tracks down properties that address your issues. These are commonly private properties and a combination of obligation and value bargains.

Here is an itemized Fundrise survey post I composed for more data.

3. Much Smaller Capital Outlay

To purchase a solitary family home, you really want to concoct a 20% downpayment. That is $300,000+ to purchase a middle home in San Francisco or NYC.

If you have any desire to purchase a multi-unit investment property, you need to think of a 25% – 30% downpayment. Such bigger properties cost considerably more.

Crowdfunded land will allow you to contribute just $5,000 – $10,000 dollars to an assortment of ventures. Land crowdfunding is alluring speculation for its broadening. You can broaden your gamble across borrowers, resource types, geographic areas, and venture types.

Whether you need a NNN (triple net) retail rent or a solitary family venture, you’ll track down it on crowdfunded land stages.

4. Completely Passive Investing

One of the primary justifications for why I sold my San Francisco investment property in 2017 is result support. I would have rather not fixed the releases or supplant the lines. Neither did I need to manage excruciating inhabitants who didn’t pay their lease on time. With another child, time was excessively valuable for me to manage all the issues.

Whenever you put resources into crowdfunding land, you have no work after the speculation closes. Notwithstanding, you actually have all the front and center work. You want to dissect the REC speculation and check whether it’s ideal for your general arrangement. In any case, you ought to do that whenever you contribute.

After the assets are moved, land crowdfunding is alluring speculation since it’s overseen very much like a REIT.

As a land crowdfunding financial backer, you just sign onto your dashboard and gather your payouts electronically.

5. Let Each Platform Pick The Best Investments For You

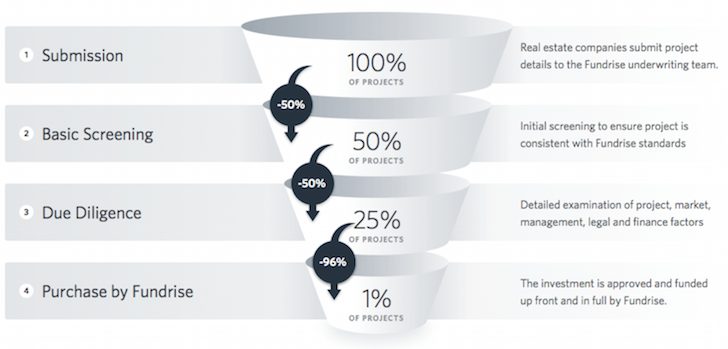

Just 5% of the arrangements Fundrise evaluates make it onto their foundation for financial backers to possibly put resources into. This cautious curation of the best arrangements assists saves you a great deal of leg with working. They do all the examinations for you available, the support, and the financial matters. The motivating forces are adjusted since, supposing that they begin putting terrible arrangements on their foundation, financial backers will take off.

6. Shorter Duration Investing Periods

The best span to hold land is for eternity. Nonetheless, to expand your liquidity needs, land crowdfunding will permit you to put resources into projects with commonly 1 – long term time skylines.

On the off chance that you look at different crowdfunding stages, you’ll observe value manages, long term time spans. The development of the obligation bargains is two years, a year, and a year.

Assuming you go with an organization that offers eREITs, your holding period can be just about as short as you need since you can sell at whatever point you need.

There are some time rules about recovering/changing out shares since land is intended for a more extended hold period. For instance, Fundrise permits you to recover shares yet makes you hang tight for 60-days.

7. Geographic Arbitrage Is Your Friend

With crowdfunding land stages, you can contribute to any place. Beach front city land is exchanging at all-time highs. Therefore, I find it substantially more reasonable to put resources into the heartland of America.

Never again do you really want to pay $4,000+ per month for a two-room loft on the coasts? Innovation permits you to live all over!