What is the record number on a check?

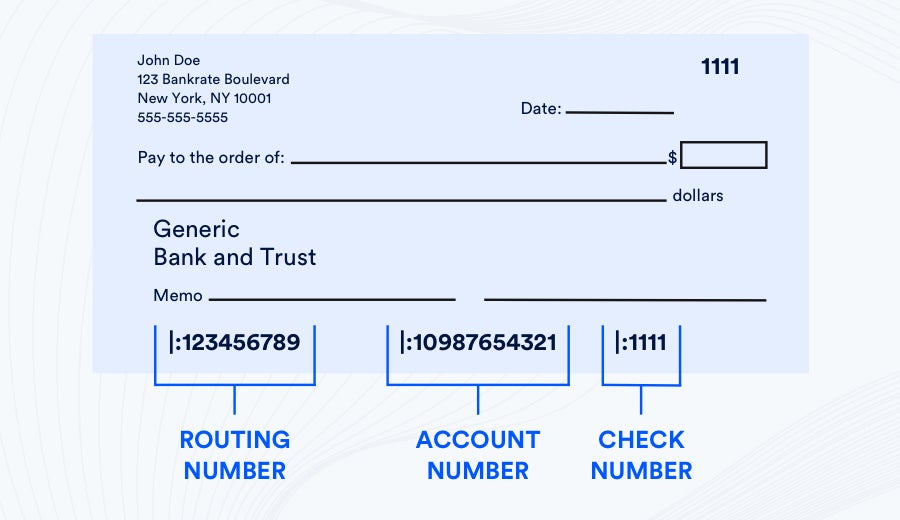

The record number on a check is utilized to distinguish your special record. Without the right record number, you might confront postponed or missing checks or charges for neglecting to cover your bills on time.

Assuming you have numerous records, (for example, an individual and business accounts), everyone will have their own record number. While a directing number is well defined for your bank or credit association, a record number is intended for you. Account numbers fluctuate long yet regularly simply go up to 12 digits.

Here are different spots where you can observe your record number.

Observe your record number on a paper proclamation

On the off chance that you have a paper bank proclamation, your record number ought to be unmistakably recorded on the highest point of it. You’ll see the expression “account number,” trailed by a progression of numbers.

Observe your record number through web based banking

Sign in to your internet banking account. When you go to the “account data” or “record rundown” segment, you ought to see your record number. Since you may just notify its last four digits from the start, click on “show” to get your total number.

Call your bank

Call your bank to address a client assistance delegate. After the person asks you a couple of safety inquiries to confirm your character, the delegate will give your record number via telephone.