Best Real Estate Crowdfunding Platforms

With Real Estate crowdfunding, you don’t have to risk $100,000 or more to put resources into business land. All things being equal, you can contribute for much lower sums, for example, $5,000. The best land crowdfunding stages today are:

CrowdStreet

Established in 2014, CrowdStreet is situated in Portland and associates certify financial backers with a wide scope of obligation and value business land speculations.

CrowdStreet is extraordinary in light of the fact that they center fundamentally around 18-hour urban communities (auxiliary urban areas) with lower valuations, higher net rental yields, and possibly higher development.

Fundrise

Fundrise was established in 2012 and is accessible to licensed financial backers and non-certify financial backers. I’ve worked with Fundrise for as long as anyone can remember, and they’ve reliably intrigued me with their advancement.

They are trailblazers of the eREIT item. Most of late, they were the initial ones to send off an Opportunity Fund in the land crowdfunding space to make the most of new expense regulations.

Both of these stages are the most seasoned and biggest Real Estate crowdfunding stages today. They have the best commercial centers and the most grounded endorsing of arrangements.

Financial backers ought to painstakingly think about their own venture targets while surveying the array of Real Estate open doors that are accessible.

Keep in mind that land speculations have many gambling factors. It is critical to survey the full contribution materials for any venture that is being assessed.

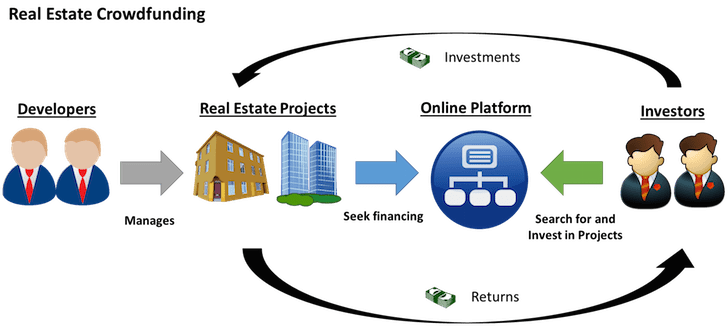

So exactly how does real estate crowdfunding work? Real Estate crowdfunding (partnership) is an exchange between a Sponsor and financial backers like you and me.

An Example Of A Real Estate Crowdfunding Investment

Land crowdfunding ventures are organized with the goal that the support is propelled to guarantee the speculation performs well for everybody. We should check out an illustration of a favored return.

On the off chance that you’re a detached financial backer who puts $100,000 in an arrangement with a 10% favored return, you could bring back home $10,000 every year once the property brings in sufficient cash to make payouts conceivable.

After every financial backer gets a favored return, the leftover cash is conveyed between the Sponsor and the financial backers in light of the partnership’s benefit split structure.

In the event that, for instance, the benefits split structure is 70/30 — financial backers net 70% of the benefits in the wake of accepting their favored returns and the support nets 30% after the favored return.

For instance, after everybody accepts their favored return in a 70/30 arrangement, and there is 1 million excess, the financial backers would get 700k and the Sponsor would get 300k.

The Sponsor sources create, and directors a land project and a gathering of financial backers. Look at this realistic beneath that makes sense of the interaction outwardly.

Financial backers Pool Financial And Intellectual Resources

Real Estate crowdfunding is a powerful way for financial backers to pool their monetary and scholarly assets to put resources into properties and tasks a lot greater than they could bear or oversee all alone.

The fundamentals of land crowdfunding aren’t too unique in relation to two people opening a bar together. The Sponsor is the director and administrator of the arrangement.

At the end of the day, the Sponsor contributes the perspiration value. This incorporates investigating properties, raising assets, and dealing with the speculation property’s everyday tasks. Then again, the financial backers give a large portion of the monetary value.

The Sponsor is normally answerable for effective financial planning somewhere in the range of 5-20% of the complete required value capital. On the other hand, financial backers are in the middle between 80-95% of the aggregate. Clearly, the more the Sponsor can put resources into the property, the better for financial backers. Financial backers need Sponsors with so a lot “dogs in the fight” as could really be expected.

Real Estate Syndication Structures

How about we plunge significantly further into REC as we answer how Real Estate crowdfunding works.

Land partnerships are easy to set up and accompanied worked in assurances for all gatherings. The design is normally a Limited Liability Company or a Limited Partnership. The Sponsor is by and large taking part as the General Partner or Manager. Furthermore, the financial backers are partaking as restricted accomplices or aloof individuals.

These LLCs can likewise be Special Purpose Vehicles (SPVs). The land crowdfunding stage and the financial backers in the stage have NO case on these SPVs or LLCs.

What might be said about the freedoms of the Sponsor and Investors? Everything is gone ahead in the LLC Operating Agreement or LP Partnership Agreement. This incorporates privileges to conveyances, casting ballot rights, and the Sponsor’s freedoms to charges for dealing with the speculation.

Real Estate Crowdfunding Profits

How does land crowdfunding work with respect to benefit? Benefits are from rental pay and property appreciation and deal.

Rental pay from a partnered property is conveyed to financial backers from the Sponsor. This is ordinarily on a month-to-month or quarterly premise as per preset terms. A property’s estimation as a rule increases in value over the long run. Accordingly, financial backers can net higher leases and procure bigger benefits when the property is sold.

Installment relies on the time the venture needs to develop; a few sorts of partnerships are over inside 6 a year while others can require 7-10 years. Each and every individual who contributes gets some portion of the benefits.

Deadlines

The Sponsor will propose a Target Date for the exit, however, such deadlines are simply best guesses. Imagine a scenario in which the deadline so is in a bear market. In those cases, it could be judicious to hang on and gather lease until the cycle turns.

At the arrangement’s start, the Sponsor might acquire a typical securing expense of 1%. Despite the fact that it very well may be somewhere in the range of .5 to 2% relying on the exchange. Before a Sponsor partakes in the benefits of their work as chief and advertiser, all financial backers get what is known as a ‘favored return.’

The favored return is a benchmark installment disseminated to all financial backers. It is normally around 5-10% every year of the underlying cash contributed.

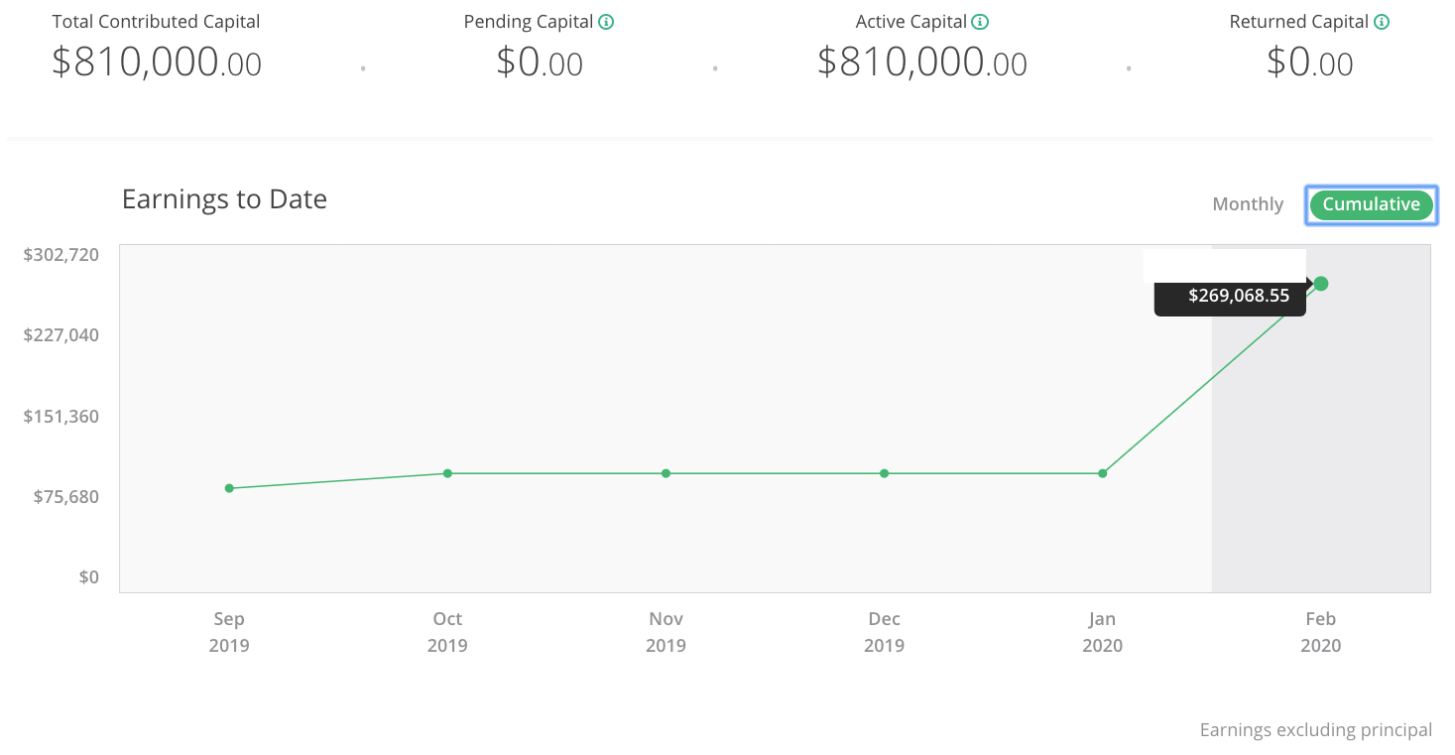

The following is my land crowdfunding dashboard where I hold $810,000.

Real Estate Crowdfunding Statistics

In 2020, more than 60,000 financial backers took part in partnerships.

- The typical size of a Real Estate offering was 2.3 million.

- Aloof financial backers concocted 80-95% of the underlying capital speculation

- Supports thought of 5-20% of the underlying capital venture

- Financial backers got a favored return going from 5-10%.

- The typical favored return was 8%.

- Supports got a procurement charge of .5 to 2%. The typical obtaining charge was 1%.

- Supports got a property the board charge somewhere in the range of 2 and 9%.

Real Estate Crowdfunding Progress

Before the web, land partnerships expected intrigued financial backers to have a Real Estate organization of partner accomplices to track down dependable, beneficial arrangements to purchase portions of.

Like the two people opening up a bar together, the person with the bar experience needed to some way or meet the person with the cash, as well as the other way around. Quick forward a couple of years and things have truly changed for land partnerships, with the assistance of the web and the approach of crowdfunding.

Real Estate crowdfunding gives admittance to the monetary essentials of an arrangement and makes it simple for certify financial backers to buy shares without utilizing the old model of nation club casual chitchat and caddy expenses.

Crowdfunding is a method for fund-raising through the web for a major task with the assistance of a ‘horde’ of financial backers. In the event that a venture gets sufficient financing, it’s a “go.” If not, the cash is gotten back to financial backers.

Crowdfunded land partnerships are more open, have lower venture essentials, and deal with an abundance of online undertaking data accessible to possible financial backers.