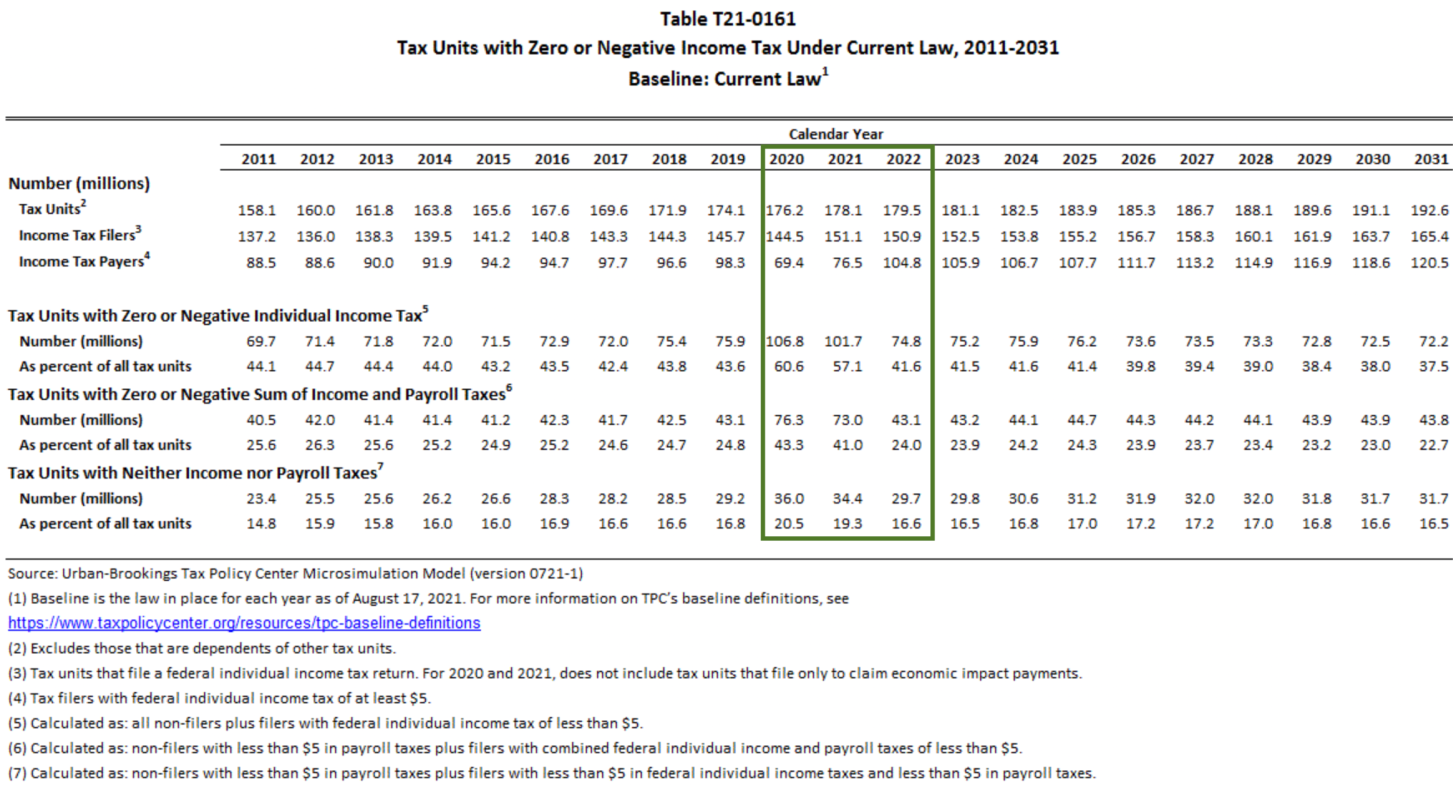

Most working Americans didn’t pay government personal charges in 2020. As per the graph underneath, apparently 106.8 million out of 176.2 million complete annual expense filers didn’t settle government personal duties. That adds up to 60.6 of Americans who don’t settle government annual duty!

Considering there are about 332 million Americans, what has been going on with the other 156 million “charge units”? Indeed, the other 156 million are either kids, resigned, or too old to even consider working.

Examine the information for you and let me know if you’re seeing how the situation is playing out. The figure for the level of Americans who pay government personal expenses expansions in 2022. Yet, we won’t be aware until 2023.

The Tax Policy Center additionally appraises that 57.1% of working Americans in 2021 will not need to pay government annual assessments by the same token. The purposes behind the flood in non-bureaucratic personal expenses payers are clearly COVID and the many tax reductions the public authority acquainted with assistance salvage our laborers.

In excess of 20 million specialists lost their positions in 2020 with low-pay laborers hardest hit. Whenever you add on refundable tax breaks, for example, the Child Tax Credit (CTC), the Earned Income Tax Credit (EITC), and improvement checks, it’s more obvious why 40% of additional functioning Americans in 2020 paid no government annual expenses.

The Future Percentage Of Americans Paying Federal Income Taxes

Maybe what’s most fascinating are the Tax Policy Center’s estimates.

By 2022, the Center appraisals 41.6% of Americans won’t pay government personal charges as the economy recuperates. I accept this conjecture is too forceful given the level of non-payers has gone from 42.4% – to 44.7% from 2011 to 2019.

Here are the justifications for why I think the level of Americans paying no government personal charges will be between 47% – 52% for the following 10 years. I exceptionally question just 37% of Americans won’t pay government personal charges as the Tax Policy Center predicts by 2031.

1) Once The Cat Is Out Of The Bag

We should look on the brilliant side. A large number of Americans have encountered the delights of NOT working. Individuals I’ve addressed who’ve had the option to get upgraded joblessness benefits, boost checks, and tax reductions have all been enormously valuable the help.

They’ve had the option to invest more energy with their family, play more noontime tennis, and carry on with a more adjusted way of life. A few states even paid more in joblessness benefits than the middle pay.

In 2020, I could only occasionally get a tennis court in a recreational area between 10 am – 1 pm in light of the fact that so many of the café laborers and gig economy laborers quit working. One fella happily told me, “I love my new business, the EDD (Employment Development Department)!”

Whenever you’ve become accustomed to a new, better approach to everyday life, it’s exceptionally difficult to return to the former approach to everyday life. Simply take a gander at the most recent studies from representatives who’ve had the option to telecommute since March 2020. Any inexorably higher level of respondents wishes to telecommute until the end of time.

2) Different Politics In Power

We have President Biden in office. Consequently, we ought to expect to proceed with greater taxpayer-supported initiatives to help more individuals, not less. The greater government boost that is given, at the edge, the less boosted individuals are to work.

Keep in mind, that we need to contrast President Biden’s financial strategies with President Trump’s monetary arrangements while making government personal expense rate estimates.

Further, with President Biden’s endorsement appraisals dropping because of the Afghanistan circumstance and the ascent of the delta variation, there is a developing gamble the Democrats will lose their greater part in Congress after the 2022 decisions.

VP Harris additionally appears to have lost her shine. In this way, the Democrats will be boosted to keep upgrading spending high through the 2024 Presidential political race.

3) Potentially Higher Taxes For All

To subsidize greater taxpayer-supported initiatives requires higher assessments and more deficient spending. In this way, at the edge, higher-pay workers will be less boosted to work. These citizens will in any case be recorded as settling government personal assessments however basically be saving money.

Nonetheless, there is an opportunity for government spending gains out of influence. Assuming this is the case, there might be higher duties on the working class and lower working class to help spread out the expense.

If this somehow managed to occur, fewer individuals will be boosted to fill in so much. Accordingly, there will be a lower level of Americans who will make good on government personal duties. Further, fewer Americans will give to the noble causes since they are now being burdened so high.

4) A Growing Percentage Of Entrepreneurs And Freelancers

Around 4.3 million new business applications were documented in 2020, just about 1 million more than in 2019, as indicated by figures from the U.S. Evaluation Bureau.

Contrasted with W2-pay workers, business people have a lot more ways of diminishing their assessment risk. For the initial quite a long while of an independent company’s life, much compensations next to zero government annual assessments because of startup costs.

The quantity of sole owners and entrepreneurs is supposed to increment before very long. The general pattern is for additional individuals to need to work independently, not less. Thus, there ought to be increasingly few individuals who will make good on government personal duties, not more.

Maybe You Should Also Stop Paying Federal Income Taxes

The Tax Policy Center and the Federal Government are arranging a ruddy picture of America’s monetary future. Nonetheless, the Center’s figure that just 37.5% of working Americans won’t pay government annual duties by 2031 is excessively forceful.

All things being equal, I estimate we’ll drift in the 47% – 52% territory for non-citizens for the following 10 years. There ought to be a primary expansion in non-citizens, not a reduction. Very much like in legislative issues, the nation will be similarly split between the payers and non-payers. Also, on the off chance that you pay no government annual assessments, you don’t need to feel remorseful since a large number don’t by the same token.

Thus, you might need to find out if you have any desire to be one of the functioning Americans who pay government annual duties to assist with supporting the people who don’t or the other way around.

I’m expecting the greater part of you would prefer to cover government annual duties. Assuming you do, that implies you’re making basically the standard derivation cutoff of $12,550 for singles and $25,100 for couples after all changes. Living on less is troublesome.

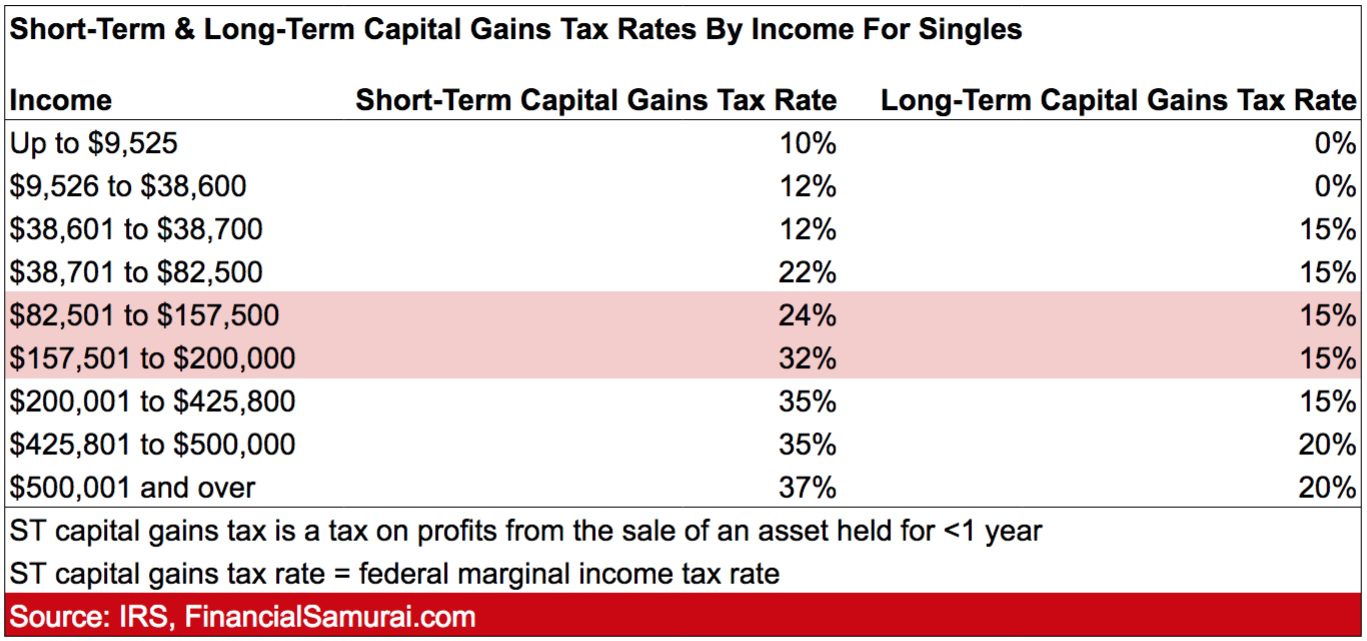

Further, I’m likewise going to accept for a moment that you’re in the middle of attempting to create however much recurring, automated revenue as could reasonably be expected to not need to work to such an extent. Basically, your speculation pay will be charged at a lower rate than W2 pay.

Nonetheless, assuming an adequate number of individuals like to pay no government annual charges, there might be a developing measure of disregard towards strategy. With no dog in the fight, you may not think often as much about making America a superior country for all.