FinTech comprises two words, “Balance” and “Tech” which alludes to Financial Technology. Monetary Technology is an arising pattern of innovation in conventional monetary administrations. FinTech is a cutting-edge innovation that gives different kinds of programming that are utilized for monetary items and administrations.

FinTech is an inventive making of the 21st century that helps its shoppers and organizations in monetary exchanges through the computerized conveyance of monetary items and administrations. Presently FinTech assists monetary enterprises with getting to their enormous number of clients carefully and gives them quick, simple, and secure exchanges. What’s more, their clients have compelling reasons need to visit bank offices actually. FinTech draws in and holds clients by digitizing information. FinTech presently additionally incorporates various ventures and areas connected with Retail Banking, Education, Investment Management, Fund-raising and furthermore non-benefit.

Reception of FinTech

As we probably are aware innovation has generally assumed a vital part in each area. Logical, innovation arose in the monetary area and take this area to the top. Presently everybody can execute anything from any place. Today nearly everybody is utilizing monetary innovation and is mindful of FinTech. All in all, what is the beginning stage when we embraced the monetary foundation?

(1887-1950) is a period when we began with innovations like messages, railways, and steamships that allowed interestingly quick transmission of monetary data across borders.

The 1950s brought us Mastercards, the 1960s brought ATM, the 1970s brought electronic stock exchange, and in the 1980s there was an ascent of bank centralized server PCs and more refined information and record-keeping frameworks. During the 1990s, the Internet and web-based business thrived.

In the 21st 100 years, we are utilizing portable wallets, installment applications, value crowdfunding, Robo-guides, cryptographic money, and a lot more monetary innovation administrations which isn’t an improvement to banking administrations but instead supplanting banking administrations totally.

Sorts of FinTech Market

- Advanced Lending and Credit

- Internet Banking

- Portable Banking

- Portable Payment

- Protection

- Worldwide Money Transfer

- Individual budget

- Value Financing

- Internet Trading

The following are the pictures to show the FinTech reception rate, FinTech classes positioned by reception rate, Investment into FinTech, and most noteworthy effect on monetary administration businesses.

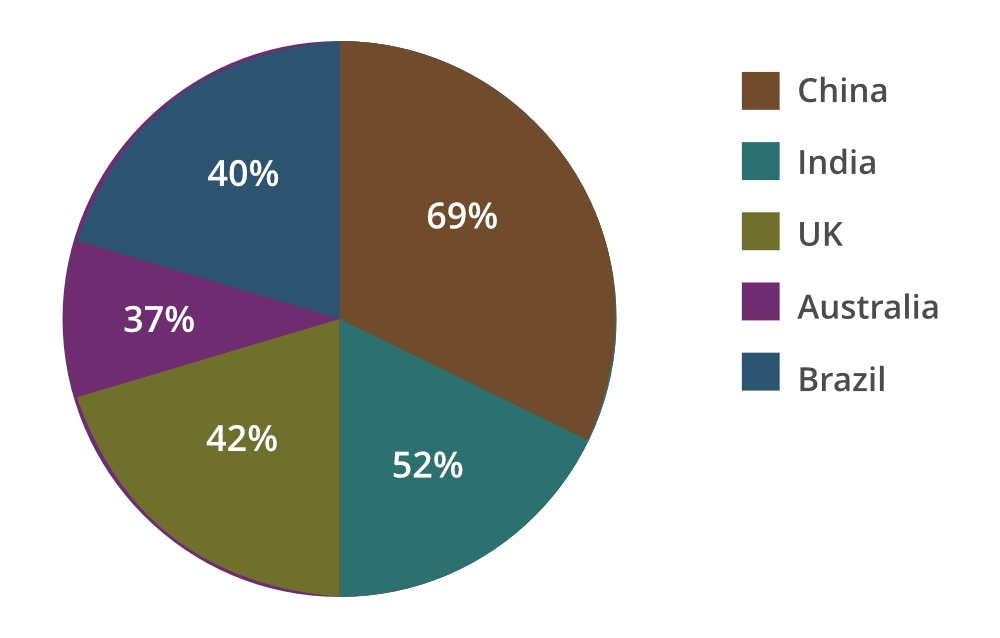

1. FinTech Adoption Rate

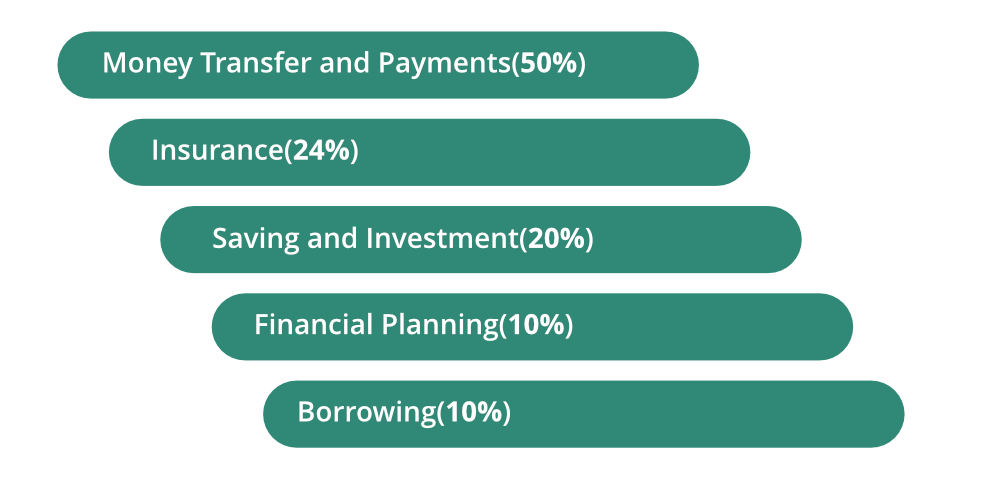

2. FinTech Categories Ranked By Adoption Rate

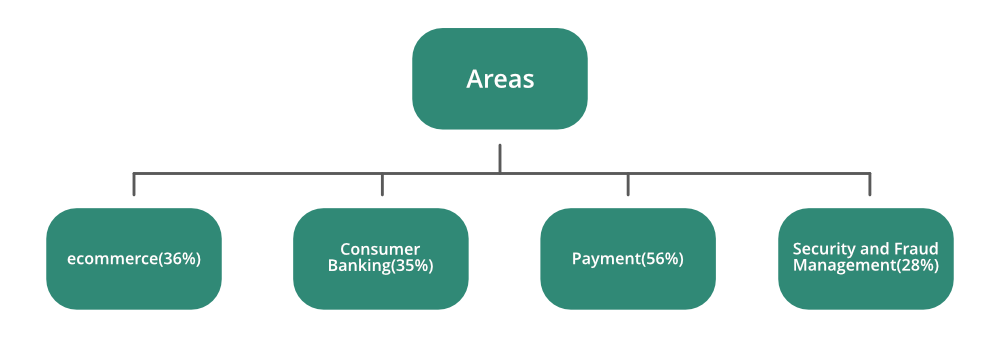

3. FinTech Investment Areas 2019

Mechanical Areas of Investment

- Information Analytics (74%)

- Artificial intelligence (64%)

- Portable (51%)

- Online protection (32%)

- Mechanical cycle robotization (30%)

- Biometrics and personality of the executives (24%)

- Blockchain(21%)

- Public cloud foundation (14%)

FinTech Investment 2017

- In Asia, Investment in FinTech Companies hit $1.2B across 41 arrangements.

- Corporative VC support stays at 23% of the absolute arrangement include in Asia in 2017.

Most prominent Impact on the Financial Services Industry in 2018

- Robo-counselors (37%)

- Commercial center/P2P Lending (23%)

- Crowdfunding (15%)

- Blockchain innovation (11%)

- Upsides and downsides of FinTech

Experts

- FinTech increments openness. Countless individuals can get into FinTech Market carefully.

- FinTech accelerate the pace of endorsement of money or protection. FinTech aids the endorsement cycle that can be finished in 24 hours or less.

- FinTech gives more noteworthy accommodation to its clients by getting to their administrations through their cell phones, tablets or PC from anyplace.

- FinTech firms appreciate low working expenses and can likewise effectively respond to their client’s needs since they have more noteworthy admittance to data about their clients.

- FinTech organizations are putting resources into significant security to guard their client’s information. For this, some of them are utilizing biometric information and encryption.

- Cheaper administrations.

Cons of FinTech:

- Restricted admittance to delicate data.

- FinTech has various guidelines, and techniques, including business exercises that are not the same as conventional banks. Thus, they could need to pay higher charges forced by OCC. It implies just those organizations that can endure which are top-performing; satisfy all prerequisites and charges forced by OCC.